The outlook for Central and Eastern European markets is still positive according to the RICS Commercial Property Monitor. Results for Q3 2017 show that both occupier and investment demand are still on the rise across the region. The peak of the current cycle is, however, undoubtedly getting closer.

Hungary has the strongest occupier market

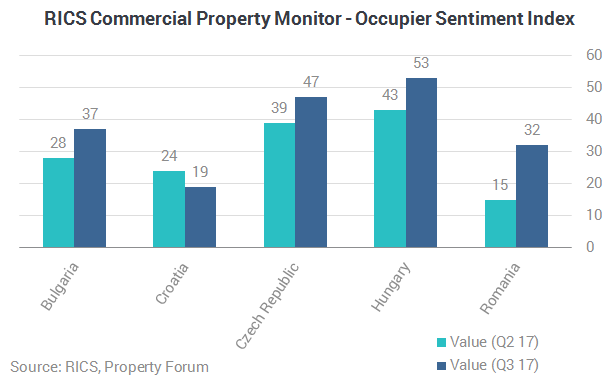

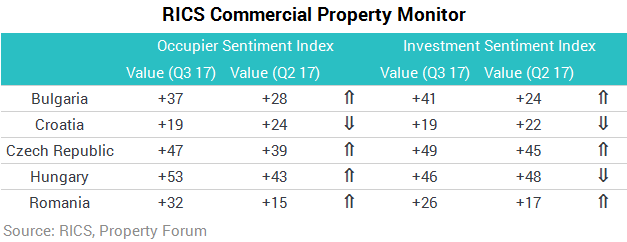

The RICS Occupier Sentiment Index (an overall measure of occupier market momentum) returned a positive reading in each CEE country tracked within the RICS Commercial Property Monitor. In Q3 2017, the OSI increased significantly in Bulgaria, the Czech Republic, Hungary and Romania, while it decreased slightly in Croatia.

Once again, Hungary posted the strongest reading in the region. Occupier demand continued to rise robustly at the headline level, with the pace of increase being marginally quicker than in the previous quarter. In the Czech Republic the OSI recorded its highest value on record with acceleration in demand growth reported across all three sectors.

The OSI also posted solid gains in Bulgaria and Romania. Occupier demand growth accelerated significantly in these countries driven by robust demand across the office sector. In Bulgaria development starts continued to rise significantly across all three sectors, especially in the office segment.

Although momentum remains slightly more modest in Croatia in comparison to the CEE average, the OSI remains positive and points to steady improvement across the occupier market.

Looking at supply, availability continued to decline in Hungary and was flat in Bulgaria, Croatia and Czech Republic, but continued to increase at the headline level in Romania.

Strong occupier demand has led to 12-month rental expectations being revised up significantly compared to the last quarter in Bulgaria, the Czech Republic and Romania. Once again, the prime sectors are expected to outpace their secondary counterparts, although in Romania the latest results project rental growth in the secondary markets catching up to the primary. Elsewhere, relative to Q2 2017, the rental outlook for the year ahead improved slightly across all sectors in Croatia and was little changed in Hungary. Overall the strongest growth projections for rental values in the coming year are in Bulgaria and Romania.

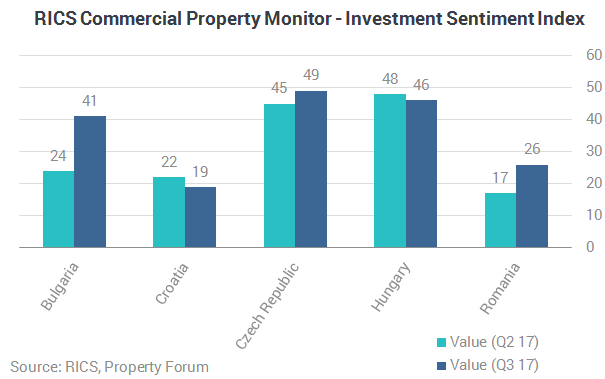

Bulgaria, the Czech Republic and Romania exhibited solid improvements in investment market activity as captured by RICS Investment Sentiment Index (an overall measure of investment market momentum). ISI readings in these three markets rose during the quarter. In Croatia and Hungary the value of the index decreased slightly, but Hungary’s current reading still points to an exceptionally strong momentum in investment market dynamics.

Investment demand continued to rise firmly in all five countries with the pace of growth picking up in Bulgaria and Hungary. Investment demand in the office sector grew especially strongly in these two countries with the retail sector also attracting considerable interest from domestic investors in Bulgaria. Investor demand is also the strongest in the office sector in Croatia and Czech Republic, while in Romania retail has proven to be the most popular asset class among investors.

"The Czech property market is experiencing unprecedented excess in investment demand over supply across all sectors and investment strategies on the back of a strong economy, a relatively stable business environment and considerable development constraints. Yields are driven to historical lows especially for the core-end of the market due to scarcity of truly prime product. Equity sources are diverse and domestic capital is now able to compete along the whole risk curve and ever increasing lot sizes," said Tomáš Jandík, CIO and Board Member at REICO investiční společnost České spořitelny, a.s.

Capital value projections for the coming year rose in all five countries with growth expected across both prime and secondary assets. The strongest growth is predicted in Hungary where respondents expect capital values to increase by nearly 6% on average in the next twelve months. Capital value projections are also solid in Bulgaria and Romania, with prime assets forecasted to post especially strong capital value gains in the coming year.

“We had a very strong year on the retail investment market – not only in Sofia, where 4 malls were sold, but also in secondary towns like Burgas, Stara Zagora and Varna, where other mall transactions were witnessed. Investor demand has noticeably increased, not only in form of requests but as real deals as well. No new malls are expected in the short-to-medium term, as the current supply is enough, maybe some small additions will come to the market in the secondary cities, like Plovdiv and Burgas. The office market is still in overheat mode as supply is below demand, especially in the Class A segment. Rents have gone up noticeably this year and capital values started to catch up since H1 2017. The residential market is also quite hot, as demand is very strong and supply hasn't caught up yet, but we expect new additions, especially in Sofia, in the next 1-2 years, which should cool the market a bit. A big chunk of the demand comes from foreigners or Bulgarians living abroad who wish to buy a second home or hold it as an investment,” commented Andrey Filev MRICS IMC, Director of Valuation and Investment Advisory at Coreside.

In each of the five CEE countries the majority of respondents believe that market conditions are consistent with the early to middle stages of an upturn. However, the proportion of respondents citing that the market is close to peaking has increased in Bulgaria (15%), the Czech Republic (85%), Hungary (35%) and Romania (16%).

“Central and Eastern Europe is not only a continuously growing target for European investors as well as other capital sources already well-established in Europe but also for newcomers from South Africa and Asia. The South African capital is specifically targeting retail assets while offices and hotels are mostly drawing the attention of the Asian players. Certainly the momentum is still there for the Czech Republic although prime yields in Prague have levelled off at their pick. We should be observing a certain downward correction of yields in CEE's less prime locations,” added Dr. Piotr Goździewicz MRICS, Director Capital Markets CEE at BNP Paribas Real Estate.

Credit conditions improved further in three of the five countries. In the Czech Republic only a small minority reported some improvement. In Romania credit conditions reportedly deteriorated very marginally during Q3 2017, following four successive quarterly improvements.