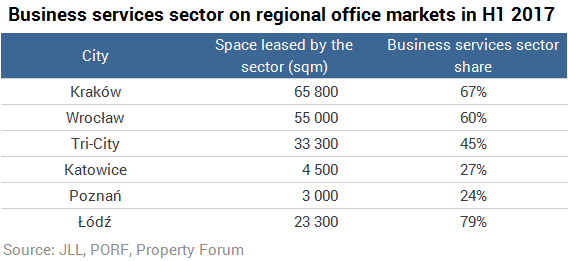

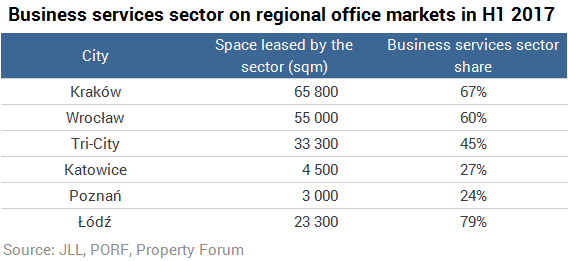

“In Poland, the business services sector continues to lease an increasing volume of office space on a year-on-year basis. Over 187,000 sqm was leased during the first six months of 2017 on the top eight regional markets outside Warsaw. If we take smaller cities into account, the total will be 210,000 sqm. Kraków accounted for the highest office take-up – nearly 66,000 sqm. Furthermore, Łódź witnessed a record-breaking share of the business services sector for office demand as nearly 80% of H1 take-up in the city was generated by companies from the BPO/SSC sector. The biggest lease agreements were signed by companies such as ATOS – 21,700 sqm in Business Park Kraszewskiego in Bydgoszcz, Brown Brothers Harriman – 14,700 sqm in Orange Office Park in Kraków and Capgemini – 13,100 sqm in Business Garden in Wrocław”, comments Mateusz Polkowski, Head of Research & Consulting at JLL.

The business services sector is the main recipient of office projects developed outside Warsaw.

“Business services centres occupy 62% of leased office space in Kraków, 50% in Wrocław and 48% in Łódź. For comparison, in Warsaw they account for a mere 9%. However, we expect to witness growth in their market share in the next few years. This is due to the specificity of Poland's capital city– historically, companies have located their headquarters in Warsaw. In total, companies from the business services sector occupy over 2 million sqm throughout Poland”, adds Mateusz Polkowski.

Today, business services centres in Poland employ 244,000 specialists who provide services for increasingly advanced processes.

“By 2020, the number of employees in the sector may be 300,000 – on a par with the number of people working now in business services centres across Great Britain. The sector's companies will need new office space which will in turn further fuel market growth”, says Jakub Sylwestrowicz, Head of Tenant Representation at JLL.

Large metropolitan areas such as Kraków, Wrocław and Tri-Ctiy continue to lead in terms of office volumes. They often record lease agreements far in excess of 10,000 sqm.

“Smaller cities, such as Szczecin, Lublin and Bydgoszcz, compete more intensively for global investors. Such cities offer competitive costs and greater access to qualified specialists. A good example of this is Uber’s recent decision to launch its services centre in Lublin as well as the lease agreement signed in Bydgoszcz by ATOS”, comments Jakub Sylwestrowicz.

New lease agreements, renewals, expansions reflect the development of the business services sector in Poland's regional cities. Kraków has been a regular feature in the top ten of Tholons Top 100 Outsourcing Destinations. In 2017, Kraków continued its progress up the ranking, climbing one spot to eighth. Today, Poland is the most developed BPO/SSC/ITO market in the Central and Eastern Europe region.

The dynamic development of the business services sector in Poland is contributing to the transformation of office space in a number of cities. One of the factors driving this transformation is the need to compete for prospective employees.

“Nowadays, the office is one of the most important recruitment tools. It should meet the needs of younger generations who are skilled in modern technologies, and are open to innovation and creative solutions. So the office space should reflect the different working styles within a team as well as having the capacity to meet the needs of the moment. Therefore, employers from the business services sector are developing different zones in their offices – some are dedicated to brainstorming sessions, some to official meetings, some to working in quiet zones while others fulfill functions outside the business. Companies are aware that an office complex can be one of their most important 'shop windows' ”, explains Anna Bartoszewicz-Wnuk, Head of Workplace Advisory at JLL.