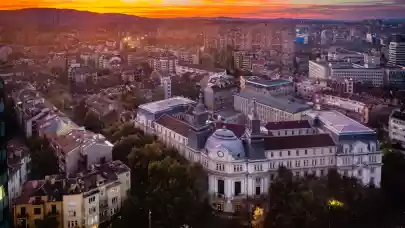

Bulgaria's real estate market in the first half of 2023 showcased a mix of stability, growth, and adaptability, according to the latest investment market overview from H1 2023, issued by Colliers. The main challenge for commercial real estate remains the ongoing business climate unpredictability.

Investment market overview

In the opening months of 2023, Bulgaria's investment market displayed resilience. The total value of investment transactions crossed the €83 million mark. The distribution of investments across sectors was as follows: 49% in office transactions, 32% in development land, 13% in mixed-use buildings, and 5% in industrial spaces. Local investors are continuing to play a significant role, contributing to 65% of the total investment volume. The size of speculative property transactions outpaced income-generating ones, indicating strong investor interest in Bulgaria's real estate sector. Local investors have continued to be active in the Bulgarian market in the last few years. During the first half of 2023, domestic capital accounted for 65% of the total volume.

The office market in Sofia

The office market in Sofia remained calm. Class A and B office spaces supply reached 2,440,700 sqm in H1 2023. The demand for quality office spaces, especially from the IT and outsourcing industries, was a main driving force, accounting for 39% of leased areas. The hybrid work model persisted, influencing office space usage and design. While rental rates remained relatively stable, the increasing emphasis on Environmental, Social, and Governance (ESG) standards signals a shift toward sustainable development.

Industrial market insights

Bulgaria's industrial market showcased resilience. The supply of modern industrial and logistics spaces in Sofia reached 1,386,700 sqm, a modest increase attributed to rising construction costs. The focus on reducing supply chain risks on a global level augmented Bulgaria's prospects for attracting foreign investments.

The retail market in Sofia

The retail landscape in Sofia has been dynamic. The vacancy rates on the main high street, Blvd. "Vitosha," reached pre-pandemic levels of 1%. Shopping centre vacancy rates also declined slightly to 3.6%. Despite global economic uncertainties, the expansion of discounters on a national scale remains a key trend. Retail park projects are in active development.

Residential market insights

The residential market in Sofia witnessed noteworthy trends in H1 2023. Supply of mid-plus and high-end residential properties increased by almost 5%, reflecting sustained demand for quality living spaces. Apartments with two bedrooms remained popular among buyers. Stable average sales and rental prices were observed, with slight increases seen in prime properties and the rental sector. The market continues to attract long-term investment interest due to stability and inflation protection,

Showcasing a mix of stability, growth, and adaptability, the Bulgarian real estate market is performing well in H1 2023. The country has a good chance to attract foreign investments due to the global drive to reduce supply chain risk.