The Bulgarian property market is booming with the total transaction volume expected to exceed €1 billion in 2017. The outlook for the future is highly positive: strong demand, underpinned by solid economic growth, encourages developers to start new projects in all segments of the market.

New record on the investment market

The Bulgarian property market recorded unprecedented investment volumes in the first nine months of 2017 with acquisitions exceeding €850 million. Compared to the previous year, the market has increased almost threefold and the total transaction volume for 2017 is expected to exceed €1 billion.

The retail sector performs best as seven transactions with large shopping centres were completed year to date. South African funds, such as NEPI, Hyprop, MAS Real Estate are the most active buyers, aiming at diversifying their property portfolios in the CEE region.

Investors' interest in Bulgaria is not surprising, given the country’s strong GDP growth (forecasted to reach 4% in 2017), strong economic fundamentals and rising consumption. These factors underpin the property market performance and help outlining the quality investment product.

"Bulgaria is back on the investors' radars, offering prime opportunities in all market segments. Apart from retail, high quality office, hotel and industrial projects are also in demand and we expect this interest to result in large transactions in the next quarters. Another positive effect is the improving market liquidity which, I believe, will further affirm the investment interest to Bulgaria", Michaela Lashova, CEO of Cushman & Wakefield Forton told Property Forum.

With office take-up in Sofia reaching 131,000 sqm in the first nine months, 2017 remains among the strongest years on record. The market is in the expansion phase of the real estate cycle, driven mostly by the growing IT and BPO industry. The leasing volume in the third quarter alone reached 44,131 sqm with net absorption accounting for about 70% of this number.

The completion of large office projects shifted the leasing activity to the CBD with a number of tenants from the shared services and financial sector migrating there. In 2017 new supply is expected to reach 124,000 sqm. Almost 80% of this space has been already let out, mirroring the shortage of ready-to-move-in prime offices.

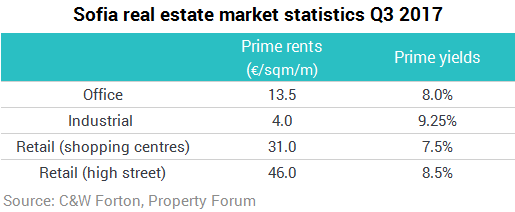

Vacancy rates vary in the range of 9.2-9.6% with no prospects for significant change by the end of 2017. Reflecting the strong demand and the shortage of new modern space, prime rents increased in H1 2017, reaching €13.5/sqm/month on average.

Development activity in Q3 remained high with the start of about 30,000 sqm of new office projects, scheduled for delivery in 2019. For the time being, more than 305,000 sqm of office space is under construction, mostly in suburbs and alongside main roads.

Healthy demand for retail space

Strong economic growth and rising sales underpinned healthy demand for modern retail space in Q3 2017. Tenants’ focus remains on well performing shopping centres and main streets in Sofia and secondary cities. Mobile operators, drugstores, toys stores, sport goods, fashion and shoe brands are actively expanding. The FMCG sector is also expanding and new openings in shopping centres and on stand-alone are expected in the fall of the year.

Prime rents in the shopping centres remained stable at €31/sqm/month. High street headline levels are €46/sqm/month with prospect to steadily increase in the next quarters.

Improving market fundamentals encourage new acquisitions and developments. The total supply of shopping centres space is expected to reach 813,000 sqm in 2018.

No vacant space left on the industrial market

Development activity continued to increase in Q3 2017 on the Bulgarian industrial market, mirroring the expansion appetite in manufacturing and logistics. With 11,500 sqm of new completions, the industrial stock in Sofia reached 925,127 sqm in the third quarter. All the deliveries were owner occupied light industrial and storage units.

The shortage of modern speculative space continued to restrain the leasing activity with logistics and retail companies remaining the main source of demand. The lack of speculative completions pushed the vacancy down to below 1%. Prime rents remained stable at €4.5/sqm on average.

Development activity across the country remains strong with a number of new entries and expansions of existing facilities. In Sofia, about 190,000 sqm are currently under construction, predominantly for owner occupation.