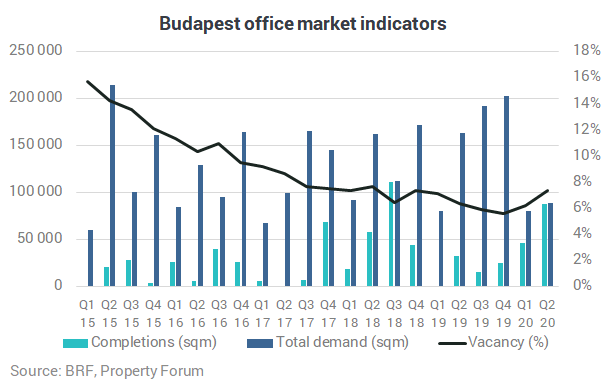

Total demand on the Budapest office market in Q2 2020 reached 87,990 sqm, representing a 46% decrease year-on-year and the number of signed transactions dropped by almost 50% compared to the same quarter of 2019, according to BRF’s latest figures.

In the second quarter of 2020, 87,750 sqm new office space was delivered to the Budapest office market in 5 buildings. Agora Tower (34,500 sqm) and Váci Greens F (25,050 sqm) were handed over in the Váci Corridor submarket. The first phase of Arena Business Campus (20,400 sqm) was completed in Non-Central Pest, additionally, Kálmán Imre 20 (2,300 sqm) was added to the stock in the CBD. The owner-occupied office stock was extended by the new HQ of Market Zrt. (5,500 sqm). Meanwhile, an office building with 8,445 sqm in the CBD was excluded from the modern stock due to a change in its functional profile.

The total modern office stock currently adds up to 3,817,305 sqm, consisting of 3,204,915 sqm Class A and B speculative office space, as well as 612,390 sqm owner-occupied space.

The office vacancy rate has increased to 7.3%, representing a 1 p.p. increase quarter-on-quarter, and a 1.1 p.p. growth year-on-year. The lowest vacancy rate of 2.8% was measured in the North Buda submarket whereas the Periphery still suffers from an overwhelming 33.6% vacancy rate. The net absorption in the second quarter amounted to 31 430 sqm.

Total demand in the second quarter of 2020 reached 87,990 sqm, representing a 46% decrease year-on-year. Out of the total leasing activity, renewals still represented the largest share, increasing even further. In the second quarter of 2020, 55% of the total demand was made up of lease renewals. New leases accounted for 27%, expansions for 4%, while pre-leases made up 14% of the total demand.

The strongest occupational activity was recorded in the Váci Road submarket, attracting 25% of the total demand. Central Pest submarket ranked second in this respect with a share of 23%, and it was followed by South Buda submarket as 19% of the total demand was realised here.

According to the BRF, 114 office agreements were concluded in the second quarter of 2020, the number of signed transactions dropped by almost 50% compared to the same quarter of 2019. The average deal size amounted to 772 sqm which is in line with the figure measured in the second quarter of 2019.

BRF registered 9 transactions occupying more than 3,000 sqm office area split into 3 new transactions, 4 renewals and 2 pre-lease agreements.

Overall, the largest transaction was a pre-lease agreement for 8,000 sqm in the South Buda submarket; while the largest new transaction in the existing stock was concluded for more than 7,000 sqm in the Central Pest submarket. The largest renewal was registered in Westend City Center at 4,790 sqm.

The Q2 2020 office market statistics already reflected the economic restrictions triggered by the COVID-19 pandemic. Total leasing activity decreased considerably as the number of transactions showed a significant reduction. Based on headline rents in the current availability, only minimal rent correction has been registered, mainly in Class B office schemes.

The Budapest Research Forum (BRF) comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.