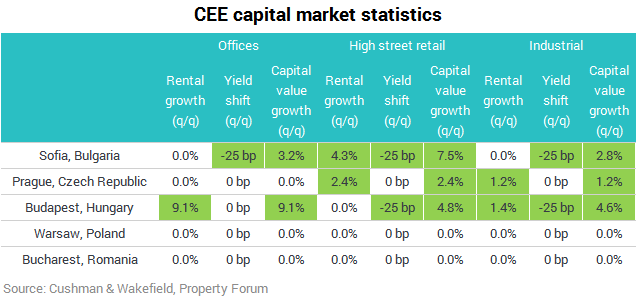

European office rental growth slowed to 0.4% over the quarter, though still posted a respectable 2.4% annualised growth. Budapest led the way with growth of 9.1% across the quarter, supported by strong demand, historically-low vacancy rates and a lack of Class A space. Demand for logistics space is supporting rental growth and driving yields lower across Europe, according to Cushman & Wakefield’s latest DNA of Real Estate report.

Logistics rents grew by 0.6% at a European level in the final quarter of 2017, ahead of offices at 0.4% and a 0.3% decline in retail. Prime logistics yields also saw the strongest sectoral compression across the quarter, falling on average 14bps, and 39bps over the year, to 6.15% with French and German markets registering some of the steepest falls.

Logistics

Nigel Almond, Cushman & Wakefield’s Head of Data Analytics, said: “Growth across the logistics sector is concentrated in a select number of cities, with around two thirds of markets reporting no growth over the quarter. Where growth did occur it tended to be strong, as in the Spanish markets of Barcelona and Madrid which grew by 8.3% and 5% respectively on the back of strong leasing activity which included pre-letting of larger units driven by demand from 3PLs and ecommerce related activity.”

Vienna reported the biggest quarter-on-quarter increase of all markets, with rents growing 10% from a low base. The city has benefitted from modern logistics space being built around the city and increased demand for these facilities. Pockets of growth were also evident in the UK regions, with Manchester rents up 7.1%, as the growth of e-commerce, and the need to improve supply chains, supported demand.

High Street Retail

In contrast, rents on the high street posted a second quarterly decline of 0.3%, with annual growth also turning negative (-0.3%) for the first time since 2010. This brought to an end a run of growth during which the European high street rent index rose by nearly 40%. The fall in rents is in selected markets, with Istanbul reporting a near 10% decline during the quarter, taking the annual fall of nearly 25%, as underlying risks to the economy and exchange rate volatility limited retailers’ expansion despite the broader economic growth and consumption. Rents for two thirds of markets were flat for two consecutive quarters.

High street yields continue to compress, although the biggest movement is now being seen outside core locations.

Darren Yates, Head of EMEA Retail Research & Insight, Cushman & Wakefield, added: “A number of Europe’s major high streets continue to experience rental uplift, in line with the more positive economic data coming through in recent months. However, this trend masks the ongoing polarisation between the strongest and weakest parts of the market, with retailers focusing increasingly on pruning unprofitable stores, while investing heavily in their flagship locations.”

Offices

Office rental growth slowed to 0.4% over the quarter, though still posted a respectable 2.4% annualised growth. Budapest led the way with growth of 9.1% across the quarter, supported by strong demand, historically-low vacancy rates and a lack of Class A space. All five key German office markets registered growth, led by Berlin (+5.5%) and Frankfurt (+5%), underpinned by strong leasing activity across all cities and relatively low vacancy rates – just 2.2% in Berlin – in the majority of markets. Further growth is forecast over the course of 2018.

Investment demand remains strong with full year volumes set to surpass 2016’s levels. Weight of demand continues to place downward pressure on yields with yields in most markets recording quarterly and annual falls. Office yields are also compressing but with prime yields now reaching record lows in many markets the outlook is for greater stability and only modest future movements.