In Q1 2017, Poland’s total Class A warehouse stock topped 11,613,000 sqm following the completion of nearly 533,000 sqm. Total take-up hit 925,000 sqm, representing a 45% increase, as revealed by Cushman & Wakefield in its latest report.

Warehouse supply hit a record high with 533,000 sqm delivered to the Polish market following robust developer activity in Q1 2017. The development pipeline now stands at 1,426,000 sqm. The largest volumes of new warehouse space were delivered in Bydgoszcz-Toruń (104,000 sqm), Central Poland (91,000 sqm), Poznań (84,000 sqm) and Upper Silesia (62,000 sqm). Key completions included BTS (built-to-suit) schemes for such retailers as Kaufland (45,000 sqm, Panattoni) and Carrefour (38,000 sqm, Panattoni) in Bydgoszcz and for Agata Meble in Piotrków Trybunalski (42,000 sqm).

Adrian Seeman, Consultant, Industrial and Logistics Agency, Cushman & Wakefield, and author of the report, said: “Warehouse take-up set a new high in Q1 2017 with 925,000 sqm transacted in 120 lease agreements, which represented an increase of 45% on the leasing volume recorded in the corresponding period of 2016. It was the best ever quarterly performance of the Polish warehouse market.”

The strongest leasing activity was in Upper Silesia where 22 leases were signed for a total of 292,000 sqm, including Amazon’s 135,000 sqm, and in Warsaw’s Suburbs with 192,000 sqm transacted in 34 lease agreements. Demand continues to be driven by logistics operators with a 26% share in the leasing volume recorded in Q1 2017. Other leading sectors included e-commerce (16%), retailers (12%), household appliances (11%), packaging (7%), automotive (6%) and light manufacturing (6%).

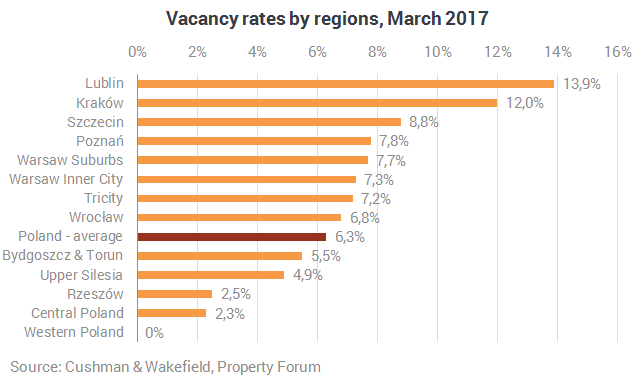

Healthy occupier demand pushed the vacancy rate down by 0.4 percentage points from 6.7% at year-end 2016 to 6.3% at the end of March 2017. Vacancies were, however, up by 0.4 percentage points on the value recorded in the corresponding period last year (5.9%). Of the core warehouse markets, the highest vacancy rates were in Krakow (12%) and Poznań (7.8%). Despite high volumes of new supply, Warsaw’s vacancy rates are gradually decreasing thanks to strong demand, standing at 7.7% for Warsaw’s Suburbs and 7.3% for Warsaw’s Inner City. The lowest volumes of vacant warehouse space were in Upper Silesia (4.9%) and traditionally in Central Poland (2.3%).

Headline rents remained flat on most warehouse markets in Poland. The highest rents are in Warsaw’s Inner City (€4.00–5.25/sqm/month) while the lowest are in Central Poland (€2.40–3.60/sqm/month) and in Warsaw’s Suburbs (€2.50–3.60/sqm/month).

Tom Listowski, Partner, Head of Industrial and Logistics Agency Poland and CEE Corporate Relations, Cushman & Wakefield, said: “Strong demand for industrial and logistics space is driven by Poland’s accelerating economic growth, low and stable rents, and new road infrastructure projects. Active market players include both well-established companies expanding or consolidating their warehouse space and newcomers seeking to benefit from favourable conditions of doing business. In addition, Poland’s warehouse market growth is also being spurred by the country’s strategic location at the crossroads of Europe’s major transport routes and the rapid growth of e-commerce as illustrated by another project completed for Amazon.”