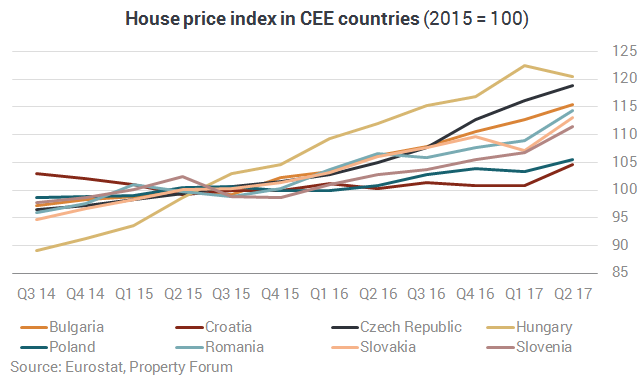

Residential markets are on the rise all over Europe. There are barely any countries where prices haven’t begun to increase since the crisis. Property Forum took a closer look at the Central and Eastern European region, to see which countries have seen the highest growth. Croatia is one of the countries where prices began to grow later rather than sooner, but this means that it may become a new hotspot for investors looking to profit from house price growth in the region.

Hungary: no need to worry

Hungary has no need to be ashamed, for in terms of growth, prices have gone up by over 35 percent since they bottomed out in 2015. Residential property in the country is now 11 percent more expensive than it was before the crisis.

Even though the pace of growth has decreased, Hungary ranked fourth among EU members in house price growth last year. The residential market is still booming: homes were 8 percent more expensive in the first quarter of 2017 than they were in the same period of 2016. Many have feared that the inflated prices will result in the formation of a bubble on the housing market, but the European Systemic Risk Board has issued no formal warning to date. The National Bank of Hungary is also closely monitoring price dynamics and has stated that it is ready to intervene should a risk of significant vulnerability arise.

Czech Republic: in motion

The Czech Republic’s residential market is also growing steadily. Although prices “only” grew by 24 percent compared to the bottom of the cycle (i.e. much less than in Hungary), the fall-back caused by the crisis was also less significant. Prices on average are now 13 percent higher than they were before the crisis. Favourable credit conditions, strong economic growth and increasing real wages also help fuel the growth of the residential market. In Q1 2017 the Czech Republic posted the strongest year-on-year price increase within the EU with a figure of 13 percent.

Bulgaria: still room for growth

The Bulgarian residential market has also started to present stronger figures. The first three months of 2017 saw prices increase by 8.8 percent on a yearly basis, which is significantly stronger than the figures of previous quarters. Average prices, however, are still nowhere near the pre-crisis high. Homes today are nearly 27 percent cheaper than they were in 2008.

Croatia: finally picking up

Even though residential markets in Central and Eastern Europe have high price increases on average, there are significant differences between the countries. In contrast to most countries mentioned above, Poland, Slovenia and Croatia have posted weaker figures: prices are currently less than 10 percent higher than they were before the crisis. In two of them, however, the pace of growth picked up in Q1 2017. In Poland prices grew by 3.3 percent on a yearly basis, which implies a stronger growth than the 0.9 percent rate of Q1 2016. And in Slovenia, prices grew by 5.9 percent in Q1 2017 compared to the 0.8 percent posted in the first quarter of last year.

The coastal regions of Croatia have performed best; at least, that is where the largest increase in prices was registered. According to data collected by the Global Property Guide, prices grew most significantly (by 4.2 percent year-on-year in 2016) in Sibenik-Knin Couny. Istria County took the second place with a yearly increase of 3.1 percent. The city where prices rose the most was Split, and the city with the most expensive homes was Dubrovnik, where the average property price reached €3349 per square metre.

The full version of this article has been published in the latest issue of Portfolio Property Magazine.