The total value of properties divested in 2022 by 7R totalled more than €430 million. This is historically a record year for the developer.

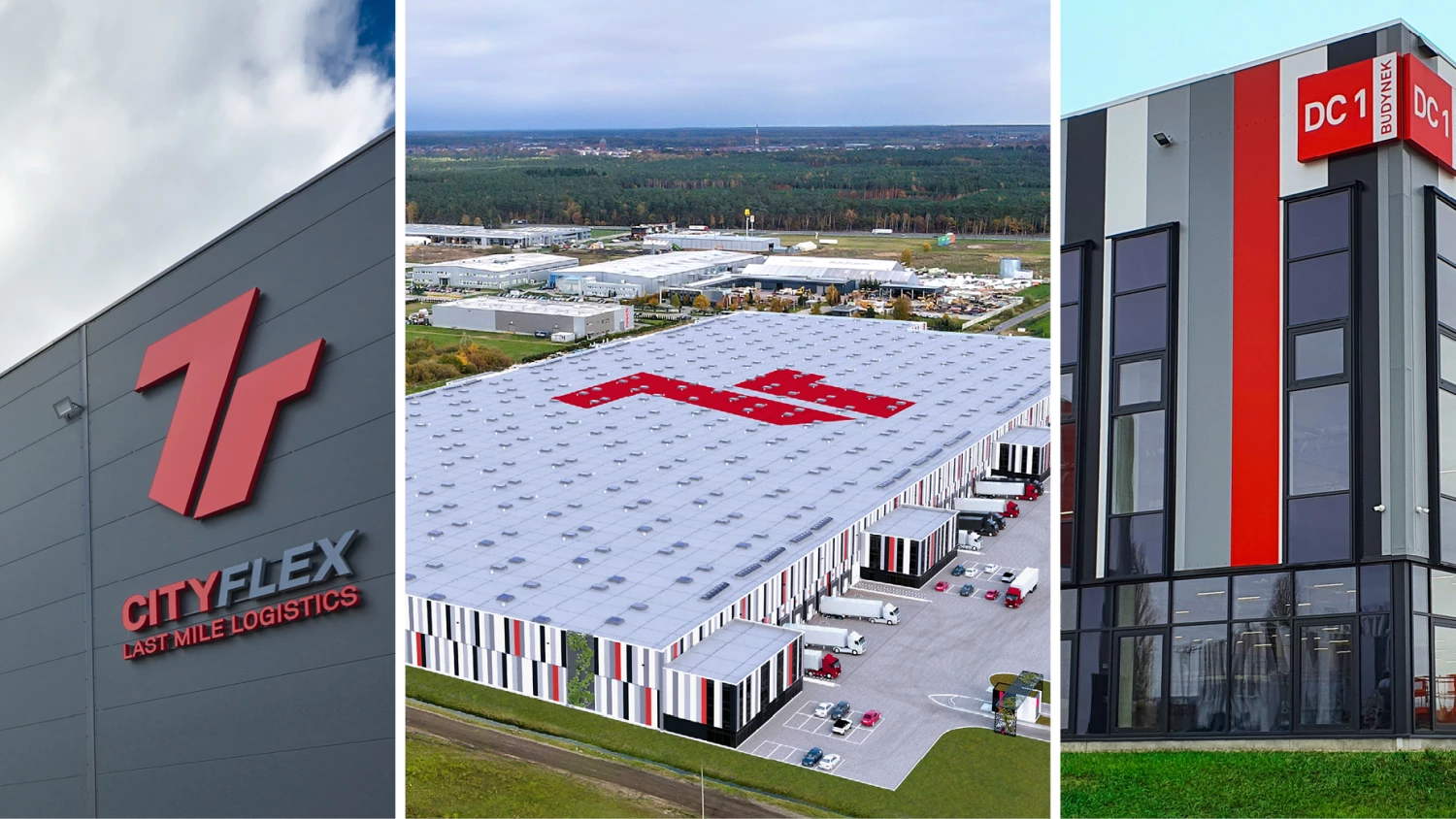

7R specialises in the construction, leasing and sale of class-A warehouses. The company's portfolio includes both warehouses operating in the last-mile logistics, large warehouse parks as well as BTS facilities – technologically advanced warehouses suited to particular clients’ requirements.

In 2022 properties divested by 7R drew the attention of many institutional investors. The developer closed more than a dozen transactions, for a total amount of over €430 million, achieving a significant share of the investment market in Poland, reaching almost 20% of all warehouse-related sales. The previous record was set in 2021, when 7R sold projects with for a total value of approx. €400 million.

“The warehouses completed by 7R are attracting the best tenants and institutional investors. We continue to work with many partners on a regular basis. This is particularly pleasing because it shows that our properties meet the high requirements not only among tenants but also the investing party, and that 7R’s relationships with international capital is becoming increasingly long-term and stable,” states Tomasz Lubowiecki, CEO of 7R.

In 2022, the largest part of the portfolio of completed projects was sold to funds managed by Macquarie Asset Management, which has recently bought (among others) 7R Park Goleniów II, comprising approx. 63,000 sqm of modern warehouse space, and in August 2022 also acquired 7R City Flex Warsaw Airport facility. Funds managed by DWS recently acquired more than 51,000 sqm within 7R Park Poznań East II, also had a significant share of the volume divested by 7R across 2022.