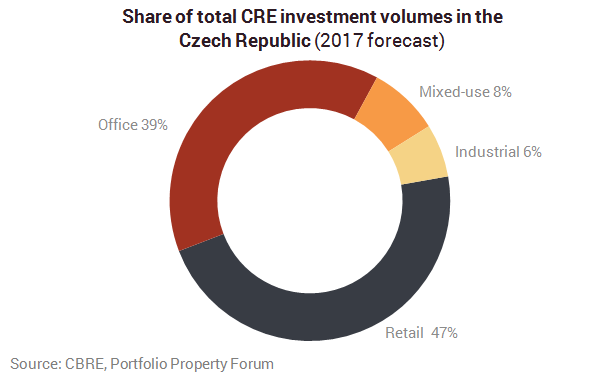

Strong demand across all investment sectors is expected to continue into 2017 in the Czech Republic and the €3 billion boundary could be exceeded once again. Retail is likely to become the most popular asset class next year, followed by offices and industrial. CBRE has released the Czech Republic Real Estate Market Outlook 2017.

“The performance of the Czech real estate market shows no sign of slowing down in 2017. We believe leasing and investment volumes will continue to rise in line with the continued strong macroeconomic performance of the country. This is the place to be in 2017”, commented Richard Curran, Managing Director of CBRE.

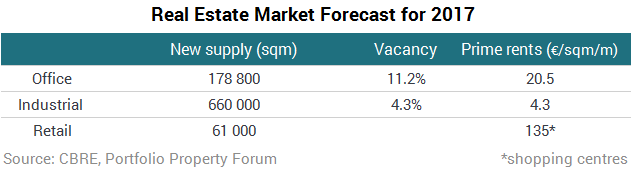

The Prague office market has been experiencing one of the strongest years in its history and the positive market sentiment is expected to continue through 2017. Take-up in the capital will be constantly driven by companies’ relocations and expansions. Higher amount of newly delivered office space should lead to short-term slight increase in the vacancy rate. Average headline rents in some of the most in demand locations may slightly increase due to the temporarily limited amount of available space. Currently, 178,800 sqm of office space in sixteen projects are under active construction and scheduled to be completed in 2017. All of them are located in established office locations such as Butovice-Stodulky, Pankrac-Budejovicka and Karlin.

The positive market sentiment continues in the retail sector as well with favourable labour market conditions supporting high consumer confidence. Retail market stability is supported by the fact that there is a small number of new shopping centres coming to the market and retailers are able to better predict to which centres to expand. In 2017, CBRE expects prime rent to grow further as there is hardly any prime space available. In 2017, three new shopping centres are scheduled to be completed: Central Jablonec, the expansion of Centrum Chodov in Prague and the expansion of IGY Ceske Budejovice. Besides new shopping centre openings, CBRE expects three new shopping centres to start construction: Borislavka (10,000 sqm), Palac Stromovka (13,000 sqm) in Prague and Avion Shopping Park in Brno (13,200 sqm). Additionally we will see one specialized centre – Outlet Arena Moravia (11,700 sqm) delivered.