In the second half of 2016 Class A offices in Bulgaria took 70% in the total supply, shows the latest research of Colliers International. The interest is generated mainly from companies coming from the outsourcing and IT sector, which has a growing share in the office market transactions – 60% during the first half of 2016 and 74% during the second. Their requirements include modern and functional layouts, comfortable workspace, convenient location, easily accessible through public transport, availability of restaurants, sports centers and additional services in close proximity. As a result to the active demand for this type of offices, the annual net absorption in quality Class A and B buildings in Sofia increased by 26%.

During the surveyed period, the distribution of completed deal types, registered by Colliers, was as follows: expansions within the current location or co-locations (11%), relocations (19%), renegotiations (25%), new entries on the market (2%), renewal of existing contracts (19%) and pre-leases (49%). The growth of the latter was almost triple, compared to the previous six months, when their share was only 17%. This development was due to the increased supply "under construction" along with the rising interest in new buildings and the related expectations for higher quality of construction in accordance with global standards. A reflection of that is the successful positioning of the first office skyscraper, followed by the announced development of a few more.

The most popular areas to both tenants and developers are Sofia Center and Broad Center. A new office zone started to shape up between Nikola Vaptsarov Blvd. (Office Park Expo 2000) and Cherni Vrah Blvd. (Paradise Center). This part of the capital is considered with high potential for further development for a variety of reasons, such as availability of land for sale, good infrastructure, excellent public transportation system, including subway. The surroundings of Capital Fort and Business Park Sofia have similar characteristics.

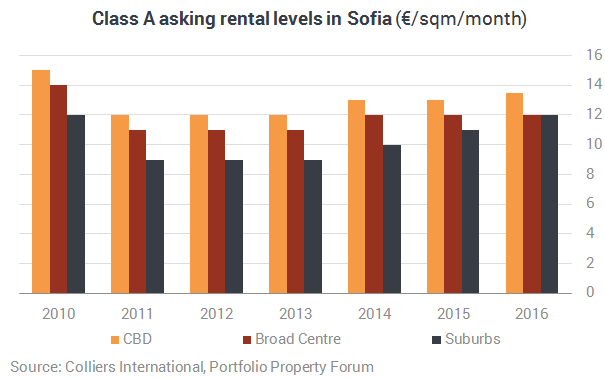

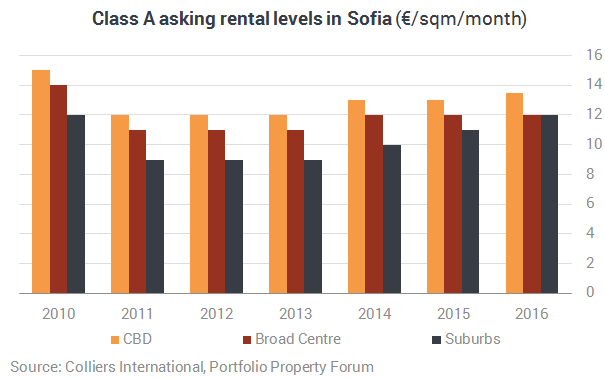

During the second half of 2016 the asking prices for buildings with use permit in place remained relatively stable. Offices in Class A projects in Sofia Center were available for €13.5/sqm/month, and €12/sqm/month in Broad Center and in the Suburban areas. Asking rental levels for buildings under construction were higher - around €14/sqm/month, due to their communicative locations and the expected quality of the office space.

Colliers forecasts that the outsourcing and IT sector will remain the main driver of the office market. In response to the growing demand by the end of 2017, 6 new projects with 115,000 sqm will be offered on the market. Pre-leases will remain as a trend, until the point when there will be a better market balance. A growing focus on building sustainability and higher construction quality will influence the concepts of the office buildings projects.