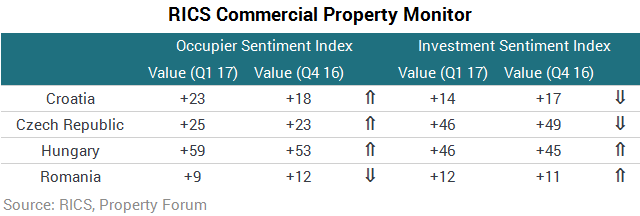

Occupier and investment sentiment continues to be positive across Central and Eastern Europe according to the RICS Commercial Property Monitor for Q1 2017. Similarly to last quarter, Hungary remains the most upbeat market globally with the Czech Republic also performing remarkably well. The picture is slightly more mixed in Croatia and Romania, still, near term momentum remains positive in the two markets.

Occupier market

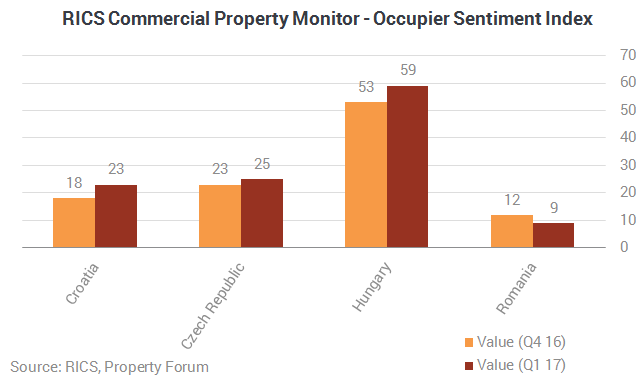

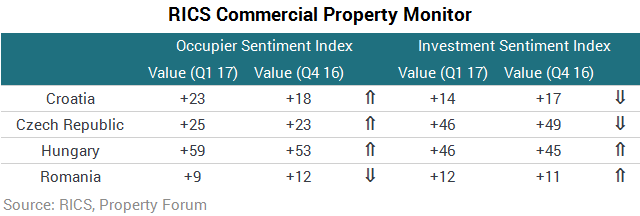

The RICS Occupier Sentiment Index (an overall measure of occupier market momentum) remains in positive territory across Croatia, the Czech Republic, Hungary and Romania, with the gauge picking up slightly in three of the four nations.

Romania was an exception, where the indicator softened somewhat and is now consistent with only marginal tightening in overall occupier market conditions. Q1 2017 results show that headline demand remained robust across all segments. Respondents, however, also continued to report a steady increase in supply across the board. Headline rents are expected to rise 1.3% over the next year.

“Following an exceptional year in terms of demand, during the first months of 2017 occupier interest has been very strong in Romania. The macroeconomic background is also very interesting, as in Q1 Romania had the highest GDP growth in Europe, of 5.7% y-o-y. On office, evolution has been spectacular and even with record deliveries demand increased as such that vacancy rate hit the lowest point in the last 9 years, under 10%. Some iconic investment deals are in the process of negotiation, which will raise awareness towards international investors about the strong points of Romania – stable political system, unprecedented macroeconomic growth, strong occupier demand and exceptionally built new properties”, commented Razvan Iorgu, Managing Director of CBRE Romania. “Regionally in CEE, expectations are that investment volume in 2017 will hit an all-time record high, set to exceed the €11.3 billion volume of last year. So far Czech Republic and Hungary have gathered most interest, but we expect investors to have a serious look at markets offering a greater yield advantage such as Slovakia and Romania.”

Hungary continues to post the strongest results – both regionally and globally – as the OSI rose during Q1 to post yet another record high (+59). This was driven by an exceptionally strong increase in occupier demand. Headline supply across the occupier market fell, following a pick-up in the previous quarter, with industrial sector availability declining at a particularly sharp rate. Expectations for rental growth remain buoyant and are led by projections for prime offices.

In Croatia, occupier demand rose firmly in the office and retail sectors, but only modestly for industrial space. Availability fell at the all-sector level for the first time since Q1 2016. The office sector experienced the most notable drop, while supply continued to creep up in the retail sector. Over the next twelve months, rental projections continue to point to growth across all prime areas of the market, led by office and retail. Meanwhile, the outlook remains flat for secondary locations.

“Office buildings in good locations continue to have high occupancy levels with many having reached 100%. This coupled with stable demand is having a positive impact on rent levels. With a rather tight pipeline it is expected that this trend will continue for the next 6-12 months. This is however not the case in secondary locations where there continues to be pressure on occupancy and rent. Most shopping centres are performing at stable levels with the more prominent ones enjoying moderate growth in occupancy and income”, added Arn Willems, Managing Director at GTC Croatia.

Respondents reported a further rise in occupier demand across all sectors in the Czech Republic with demand for Prague industrial space showing the biggest increase. Availability continued to decline in the retail and industrial segments, but held steady in the office sector. Similarly to Croatia and Romania, rental projections are subdued across secondary markets while the outlook for prime space remains significantly stronger.

“Very robust economic growth numbers for Q1 2017 across the CEE region are helping to propel occupier and investment sentiment to cycle highs. Momentum in the fastest-growing economy, Romania (GDP growth +5.7% year-on-year) continued in Q1 2017 but this level appears assumed as normal by occupiers and investors there presently. Hungary continued to accelerate, with its 4.1% year-on-year GDP growth accompanied by gross wage growth of 12.8% year on year for March. This potent mix of robust demand, underpinned by a short-term strong economic outlook in key export market Germany and wage pressures is likely to start to imply higher interest rates and thus tighter credit conditions at the margin in the quarters ahead both in Hungary and elsewhere”, commented Prague-based Mark Robinson, CEE Research Specialist at Colliers International.

Investment Market

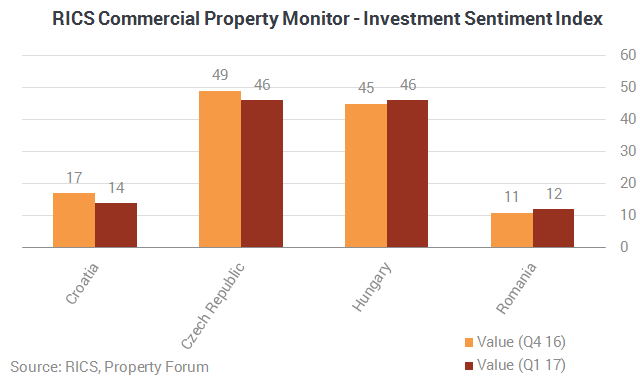

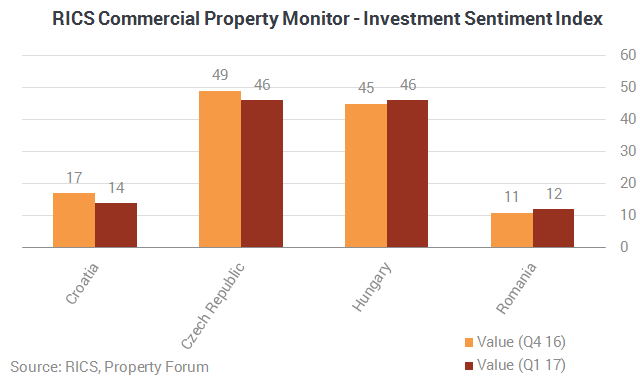

The Investment Sentiment Index (an overall measure of investment market momentum) remains firmly positive in the Czech Republic and Hungary, with both countries registering a reading of +46.

Hungary again displays the strongest twelve month projections relative to all other countries, with prime office capital values expected to see the firmest growth. Capital value expectations across all secondary sub-markets were revised slightly higher relative to Q4 2016, albeit prime sub-sectors are still expected to outperform comfortably.

In the Czech Republic, the outlook for the next 12 months is flat across secondary locations, while respondents anticipate only modest growth for prime office and industrial prices. However, prime retail values are expected to post relatively firm capital value growth. Further out, at the three year horizon, capital value growth is expected to ease slightly and 50% of respondents continue to sense that conditions in Prague are close to peaking in the current cycle.

"Exceptional lending conditions, positive market sentiment, strong economic background and reported record-breaking activity in Q1 indicate that the Czech investment market is on the right track to achieve yet another exceptional year. 20 concluded transactions with a total investment volume of over €1.35 billion represents a threefold increase over Q1 2016 and a significant pipeline of deals across all sectors confirm the Czech market being the top investment destination in CEE", said Miroslav Barnáš MRICS, Head of Capital Markets and CEO for the Czech Republic and Slovakia at JLL.

In Croatia, the main investment sentiment gauge remains in modestly positive territory, although the industrial sector continues to weigh down the headline average. Respondents in Croatia expect all prime areas of the market to post reasonable capital value gains over the year ahead. The projected growth is significantly more modest for secondary areas.

Investment sentiment in Romania remains moderately positive. It is the retail portion of the market which remains comparably weaker than office and industrial. Respondents from Romania revised one-year headline capital values forecasts up to 2.2% in Q1 2017 from the 1% forecast in Q4 2016. Interestingly, secondary office values are seen increasing 2.1% over the next year, while prime space is only expected to increase 1.9%.

In Croatia and the Czech Republic the majority of contributors feel that the market offers fair value at present. The picture is similar in Hungary with a significant share of respondents still feeling that the market is undervalued. In Romania the portion of respondents who see the market as expensive increased, while the share of those who view valuations as cheap to some degree fell in Q1 2017.

Credit conditions improved further in all four countries, with the majority of contributors reporting some degree of improvement, albeit to a lesser extent in the Czech Republic.