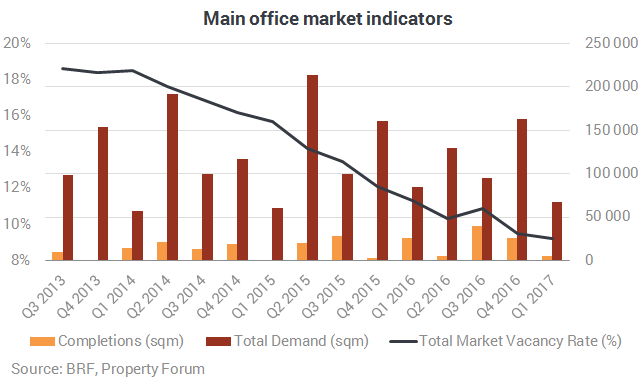

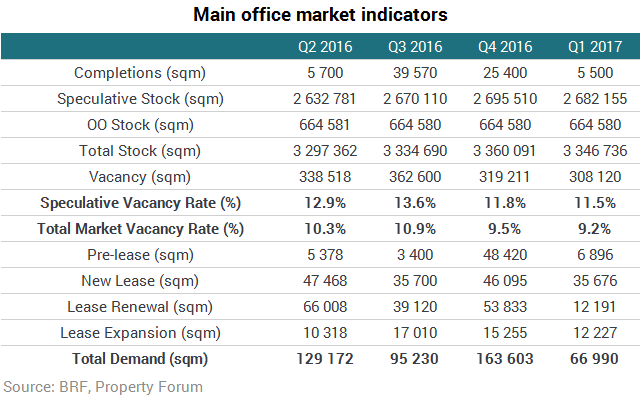

Demand continues to be strong on the Budapest office market and with new supply still limited the vacancy rate decreased further in Q1 2017. It now stands at 9.2% which is the lowest rate on record. The Budapest Research Forum published its newest figures.

BRF recorded one new office delivery in the first quarter of 2017; the new SAP wing was handed over in Graphisoft Park in North Buda, which has further increased the modern office stock by 5,500 sqm, which now extends to 3,346,735 sqm. The total stock comprises 2,682,155 sqm of Class A and Class B speculative and 664,580 sqm of owner occupied buildings.

As the result of our annual stock revision, 4 buildings were excluded from the modern stock and further 21 buildings’ GLA was amended due to re-measurements taken place over the beginning of 2017.

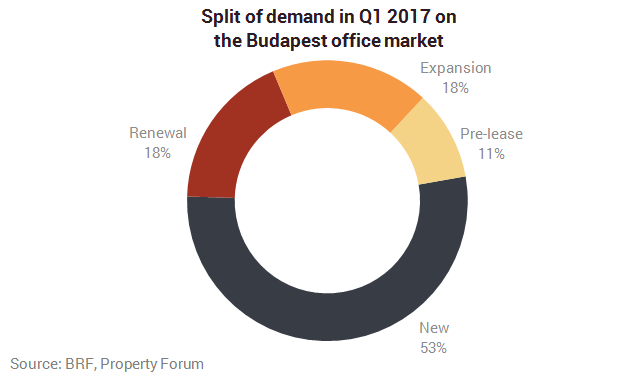

Demand in Q1 2017 was in line with the 5-year average of the first quarters’ lettings, comprising 66,990 sqm.

In terms of submarkets, the Váci Corridor had the highest leasing activity, representing more than 20% of the total demand , while Central Pest, North Buda and Central Buda were equally popular office destinations in the first quarter, each with 17% of the volume.

According to BRF, 154 deals were closed in Q1 2017, with an average size of 435 sqm, which is roughly 10% higher than the average level of the previous five Q1 periods, which averaged 396 sqm.

The quarterly net absorption totalled 7,600 sqm in Q1 2017.

The Budapest Research Forum (BRF) comprises CBRE, Colliers International, Cushman & Wakefield, Eston International, JLL and Robertson Hungary.