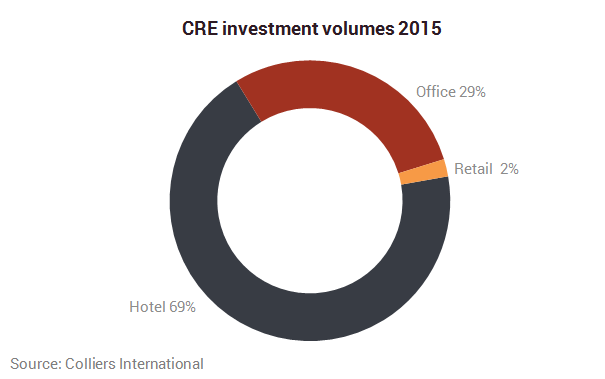

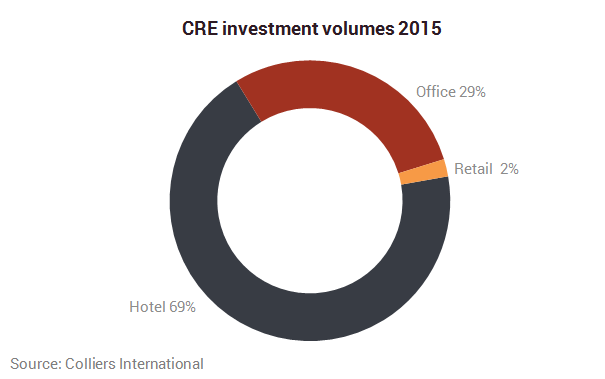

According to Colliers International's latest market research the Croatian real estate market experienced several significant investments in the retail, office and hotel and hospitality sectors in 2015. While the retail and office segments are experiencing upward pressure on rental prices, the industrial market, despite being the least developed sector, saw increased activity.

„The Croatian real estate sector expects several developments and transactions in 2016, underpinned by better economic climate, yield opportunities and improved investor sentiment. As most active markets in the coming year we see the retail, office and hotel and hospitality sectors”, said Vedrana Likan, Managing Director for Colliers International Croatia.

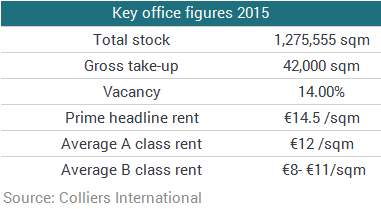

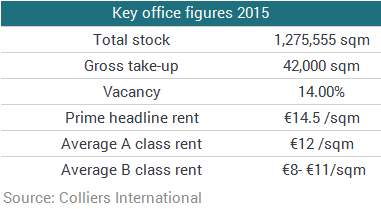

Zagreb's office market is expected to receive another 26,000 sqm of office space which includes Adris Business Center - the first office building on the market with international green building certificate LEED GOLD.

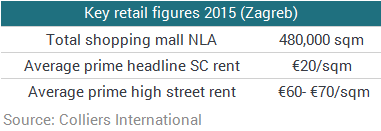

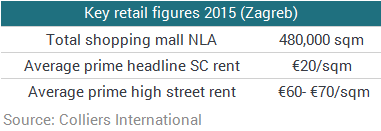

The retail market is also expanding: a large mixed use project is being developed in Dubrovnik's port Gruž with a 14,000-square-metre shopping center, while MID Europa Fund is planning to build a new shopping mall in Pula, with a GLA of 30,000 sqm and 90 retail units. Tertiary cities like Samobor and Imotski will also get new retail developments. Taking into account positive trends in consumer spending, tourism and economy in general, an upward pressure is expected on rents.

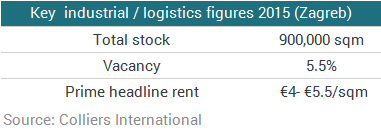

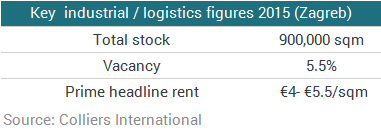

On the industrial market the increased demand for logistics space is continuing and many tenants are looking for better quality options and consider BTS projects to be the most convenient solution. Colliers expects that trend to continue in 2016 which will drive pre-development and development of new logistic centers. A further drop in the vacancy rate can be expected which might trigger new developments. Last year, higher activity in this market segment has primarily been seen in Zagreb County (where distribution and logistics centers of RALU Logistics, Zagreb Brewery, Kaufland and Lagermax were developed). Besides Zagreb and its surroundings, the most important industrial and logistics zones are Kukuljanovo near Rijeka and Dugopolje near Split.

Looking ahead, investment activity in the hotel sector is expected to continue, especially in brownfield investments. New entrants on the market can be expected, notably international hotel brands currently not present on the Croatian hotel market. The hotel and hospitality sector is currently the most attractive sector for developers and investors due to the continually high growth of tourist arrivals and overnight stays, available funding and attractive brownfield investment opportunities available through the privatization of state owned enterprises/RE portfolios.

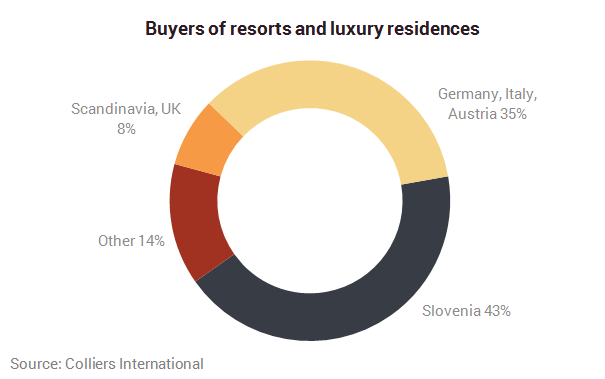

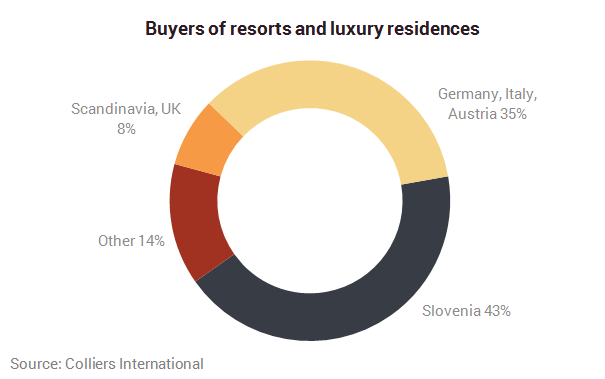

The resorts and luxury residences segment is also particularly interesting to investors. Buyers’ structure is diverse and Slovenians account for the largest portion, followed by the Swedes, Slovakians and the Brits. The most demanded luxury residences are smaller ones with prices up to €500,000. Generally looking, the supply does not yet meet the current demand characteristics and a large potential lies in the development of smaller luxury villas for sale and larger high-end villas for rent.

The Croatian real estate sector expects several developments and transactions in 2016, underpinned by a better economic climate, yield opportunities and improved investor sentiment. After several years of low liquidity 2016 will see strong investment transactions, especially in retail and office sectors. The prices have declined which led to better yield opportunities.

With the forthcoming supply, mainly driven by bank disposals, Colliers anticipates several transactions closing in 2016, making it a record year in investment sale volumes.